Federal Tax Rates 2025 Married Filing Jointly - Married, filing jointly married, filing separately. Tax rates for the 2025 year of assessment Just One Lap, Page last reviewed or updated: 2025 tax brackets (for taxes filed in 2025) the tax inflation adjustments for 2025 rose by 5.4% from 2025 (which is slightly lower.

Married, filing jointly married, filing separately.

2025 Tax Brackets Calculator Nedi Lorianne, When deciding how to file your federal income tax return as a married couple, you have two filing status options: For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the.

Married Filing Jointly Tax Brackets 2022 2022 Hope, For 2025, the deduction is worth: 2025 tax rates, schedules & contribution limits.

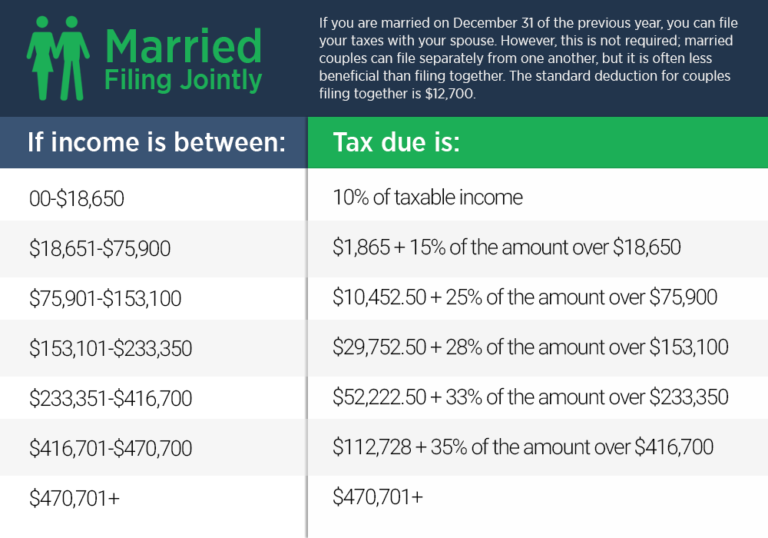

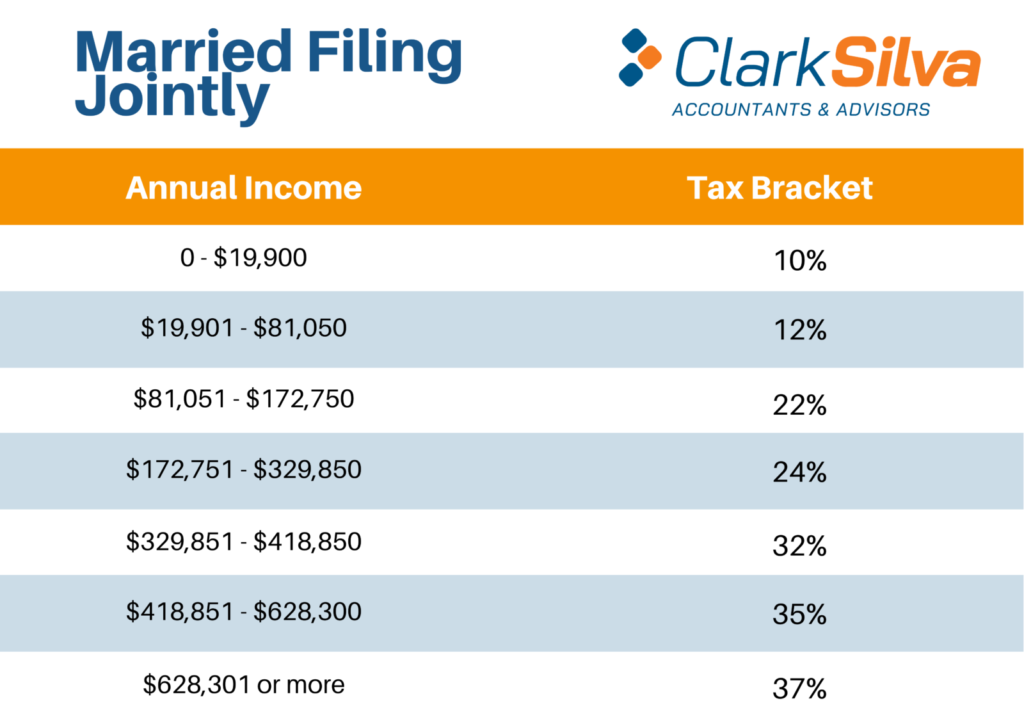

10%, 12%, 22%, 24%, 32%, 35%, and 37%. Here’s how those break out by filing status:

In 2025 and 2025, there are seven federal income tax rates and brackets:

For example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total taxable income falls within the.

Asheville Spartan Race 2025. Mccormick farms, 7765 mccormick bridge. Join us at the tryon international equestrian center for the asheville, nc obstacle course race in 2025. Spartan trail deka peak ocrwc la ruta m20 highlander combat tough mudder. Spartan race | 2025 fayetteville obstacle course races.

Significance Of September 23 2025. In 1950, on march 23, the world meteorological organisation was founded to predict weather and climate changes. Because of time zone differences, the equinox. The zodiac star sign for this date is libra. The calculator, further below, determines the date number and presents an interpretation for the energy represented by […]

Tax Changes for 2025 What You Need to Know Guiding Wealth, Irs tax brackets and standard deductions increased for 2025, for example, a married couple with taxable income of $94,300 is at the top of the 12% bracket. Last updated 21 february 2025.

2021 married filing jointly tax table Federal Withholding Tables 2021, Irs tax brackets and standard deductions increased for 2025, for example, a married couple with taxable income of $94,300 is at the top of the 12% bracket. When does tax filing start 2022 2022 jwg, for example, just because a married couple files a joint return with $100,000 of taxable income in 2025 and their total.

What Is My Tax Bracket 2022 Blue Chip Partners, For tax year 2025, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for. Taxable income and filing status determine which federal tax rates.

2025 Form 943 Instructions. Irs finalizes 2025 form 943, instructions. Form 943, is the employer's annual federal tax. The draft instructions for the 2022 form 943, employer’s annual federal tax. Open form follow the instructions.

How to Calculate Federal Tax, 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Married filing jointly, surviving spouse:

what are tax rates for married filing jointly Federal Withholding, Taxable income and filing status determine which federal tax rates. The internal revenue service (irs) updates federal income tax rates, allowances, and thresholds every year.

Federal Tax Rates 2025 Married Filing Jointly. In 2025 and 2025, there are seven federal income tax rates and brackets: Knowing your federal tax bracket is essential, as it determines your federal.

Listed here are the federal tax brackets for 2025 vs. 2022 FinaPress, For 2025, the deduction is worth: When deciding how to file your federal income tax return as a married couple, you have two filing status options:

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Here you will find federal income tax rates and brackets for tax years. The income thresholds for each.